30 to 50% time gain per analyst per day to write content or support relationship managers in their daily work

The time saved with Interactive Advisor - a total of between 30 and 50% - can now be used by the analysts for writing content, creating analyses or advising client advisors. Overall, we have massively improved the allocation of our resources, increasing the impact of our investment department with client advisors and clients.

Head Research Content and Publications, LGT

Timely research content – personalized for advisors and clients on their preferred channel

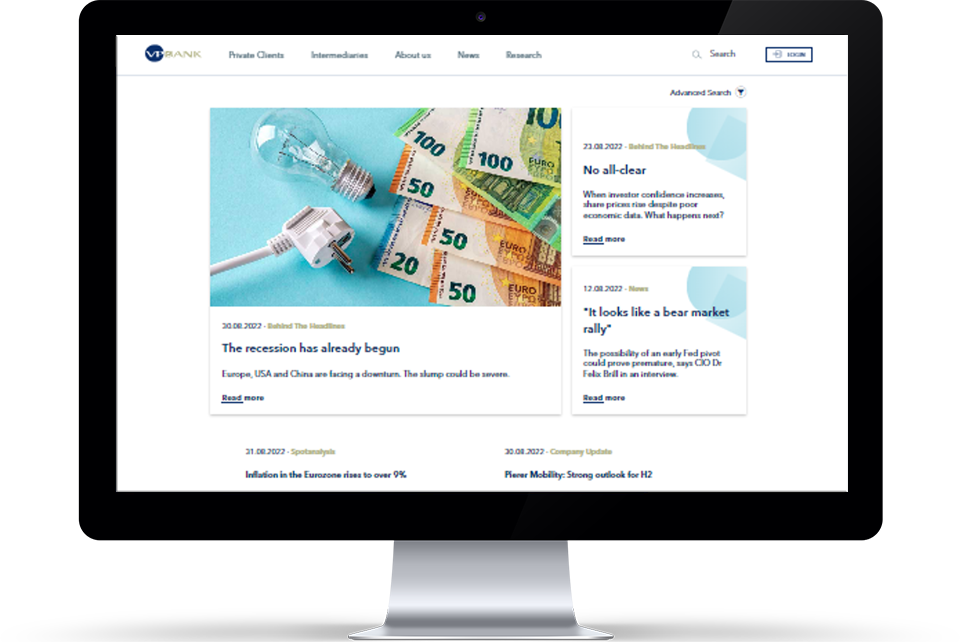

With Adviscent and their Interactive Advisor solution, we have improved the automation of the data flow and shortened the processes for preparing research content. With the new Research Portal, we have created a platform to serve all stakeholders digitally and in a recipient-friendly way with our analyses.

Chief Investment Officer, VP Bank

The Platform –

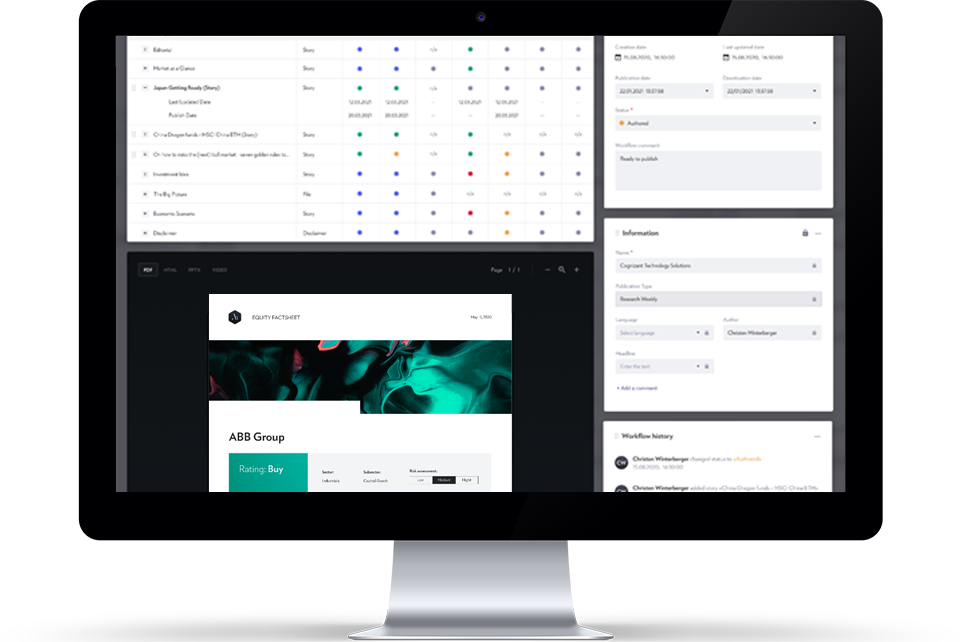

Content engine

Features

- Predefined publication and content types (e.g. factsheets, house views, investment ideas)

- Best in class editor

- Workflow engine

- Preview in HTML, PDF and PPT

- Automatic text translations

30 to 50% time gain per analyst per day

The Platform –

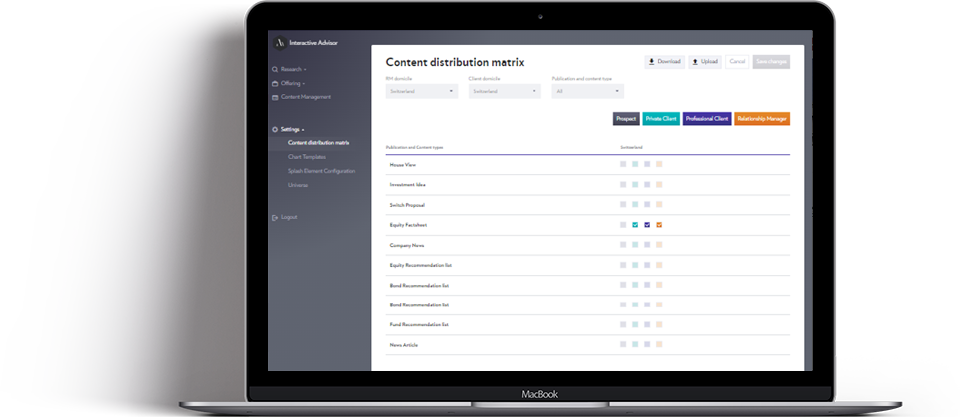

Distribution engine

Features

- Suitability Check / Interface to Suitability Engine

- Personalization Engine based on rules or custom logic

- Modular disclaimer management based on content or user

- Channel-specific content rendering as HTML or PDF

- Pure data export as XML or JSON

- Export interface for web channel / web snippet

Compliant, personalized and channel agnostic distribuiton of content

The Platform –

Research Portal

Features

- Create multiple portals based on the same content source

- Integrate research portal on all of your existing platforms for prospects, clients and advisors

- Define the structure of your research portal with WYSIWYG editor

- Content curation

Benefits for the Chief Investment Officer: Increase reach of investment communications and measure impact on all channels

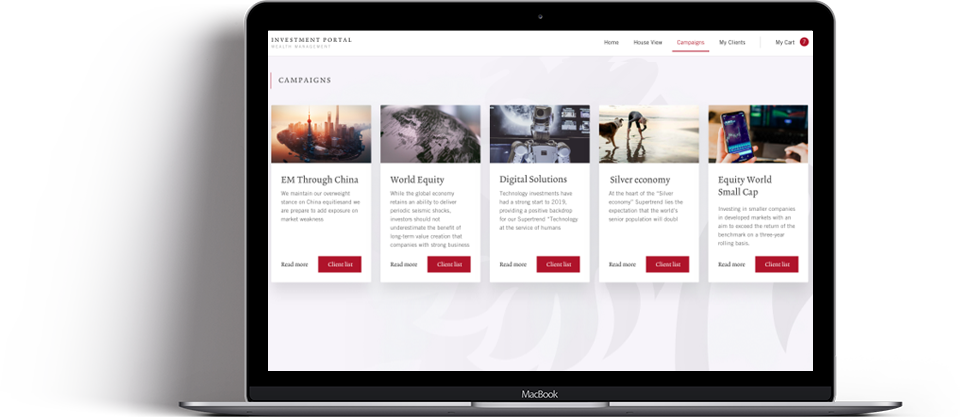

The Platform –

Campaign management

Features

- Content in client context

- Content sharing capability

- Communication history

- Feedback loop

Tripling the number of contacts per advisor per client per year

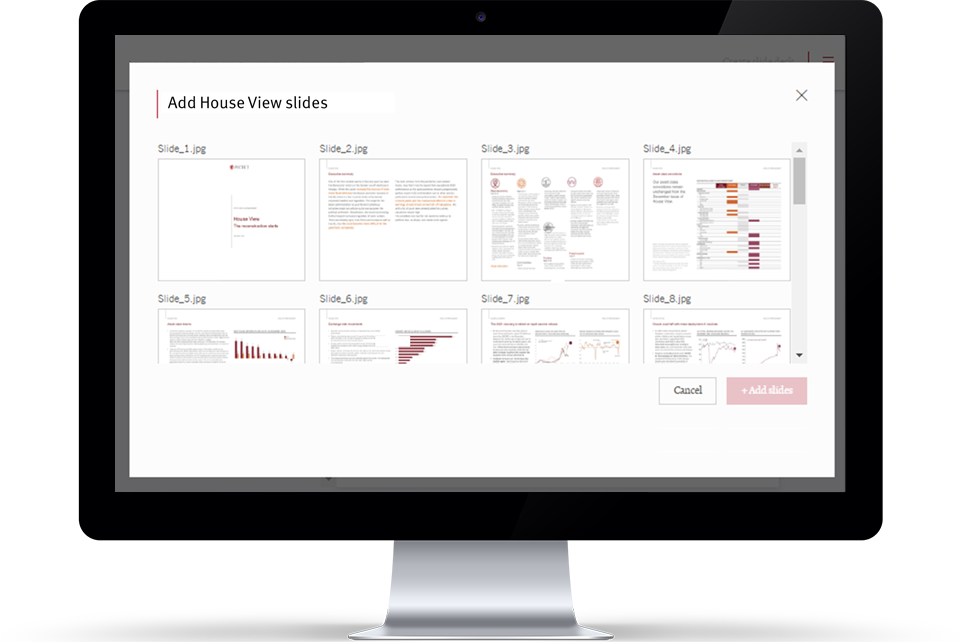

The Platform –

Slide Builder

Features

- Automated information based on user profile/ portfolio

- Create individualized pitch books for investment proposal presentation/discussion

- Matching engine ISIN – product information/ regulatory documents

- Create any output format, PPT, HTML or PDF

50% less time spent to create a custom pitch book

Product –

Connectivity

Features

- Market data: Bloomberg, Factset, Morningstar

- Front office suites: avaloq Wealth and Engage, Temenos Front Office Suite, additiv

- Core Banking: avaloq and Temenos

Best of breed – and integrated

Interactive Advisor – For the Chief Investment Office

Interactive Advisor – For advisors

Get in contact – our office in Zurich

Adviscent AG

Binzstrasse 23

8045 Zurich

Switzerland